The global oncology clinical trials market size reached USD 13.19 billion in 2023 and is projected to hit around USD 22.11 billion by 2033, expanding at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The oncology clinical trials market plays a pivotal role in advancing cancer care by enabling the discovery and validation of novel therapies, diagnostics, and treatment paradigms. These trials serve as the cornerstone of oncology research, helping to translate scientific discoveries into life-saving interventions for millions of patients worldwide. As cancer remains one of the leading causes of mortality globally, the need for effective and targeted therapies is more pressing than ever—driving significant investment and innovation within the clinical trial ecosystem.

Oncology clinical trials are structured to evaluate the safety, efficacy, pharmacokinetics, and therapeutic potential of experimental drugs, biologics, and medical devices in patients with various cancer types. These trials range from first-in-human Phase I studies to large-scale Phase III and IV studies involving thousands of patients across geographies. They are often conducted in partnership between pharmaceutical companies, contract research organizations (CROs), academic institutions, and regulatory agencies.

The increasing complexity of cancer biology, emergence of personalized medicine, and rise of immuno-oncology have dramatically altered the clinical trial landscape. The advent of precision oncology, in which treatments are tailored based on individual genetic profiles, has introduced biomarker-driven trials, adaptive trial designs, and basket/umbrella trial formats. These innovations are not only enhancing trial efficiency but also reducing time-to-market for breakthrough therapies.

In parallel, digitalization, remote patient monitoring, and AI-powered data analytics are being integrated into clinical trial workflows, improving patient recruitment, retention, and data management. The oncology clinical trials market is also being shaped by regulatory reforms and funding initiatives by governments and non-profits, aiming to accelerate access to cutting-edge cancer therapies.

Shift Toward Decentralized Clinical Trials (DCTs): Oncology trials are increasingly adopting remote monitoring, telemedicine, and home health services to enhance patient convenience and recruitment diversity.

Expansion of Biomarker-Driven and Genotype-Based Trials: Trials are now often designed around specific genetic mutations, allowing for targeted therapy development, especially in lung, breast, and colorectal cancers.

Integration of Artificial Intelligence (AI) and Machine Learning: AI is used to identify eligible patients, optimize site selection, predict trial outcomes, and analyze imaging or genomic data.

Growing Collaboration Between Pharma and CROs: To reduce costs and streamline trial operations, pharmaceutical companies are partnering with specialized CROs for trial design, site management, and regulatory compliance.

Increasing Role of Real-World Evidence (RWE): Observational and expanded access studies are being used to support regulatory submissions and post-market surveillance, complementing interventional trial data.

Adoption of Adaptive Trial Designs: These allow modifications to trial parameters mid-study, improving efficiency and reducing waste of resources.

Rising Focus on Rare and Pediatric Cancers: More clinical trials are targeting under-represented cancer types, including pediatric, hematologic, and orphan tumors.

| Report Attribute | Details |

| Market Size in 2024 | USD 13.89 Billion |

| Market Size by 2033 | USD 22.11 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Phase type, study design, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | AstraZeneca; Merck & Co. Inc.; IQVIA Inc.; Gilead Sciences, Inc.;F. Hoffmann-La Roche Ltd.; PRA Health Sciences; Syneos Health; Medpace; Novotech; Parexel International Corporation |

Phase II trials dominated the market by phase type. This phase plays a crucial role in evaluating therapeutic efficacy and optimal dosing after preliminary safety is established in Phase I. In oncology, Phase II trials often incorporate surrogate endpoints like progression-free survival (PFS) or tumor shrinkage to accelerate development timelines. Given the high attrition rate of oncology drugs, a large number of Phase II trials are conducted to de-risk candidates before proceeding to costly Phase III studies. These trials frequently adopt biomarker stratification and adaptive designs, improving efficiency and data richness.

Phase I is the fastest-growing segment, especially in early-stage biotech companies and in first-in-human trials for novel immunotherapies, cell therapies, and RNA-based drugs. With the rapid emergence of new modalities and targets, Phase I trials are becoming more complex and integrated with pharmacodynamic and biomarker endpoints. Innovative designs such as dose-escalation with expansion cohorts (DEEC) are being used to accelerate the transition from safety to efficacy evaluation. Additionally, the rise of biotech incubators and venture-backed oncology startups is fueling a robust pipeline of Phase I trials in the U.S., Europe, and Asia.

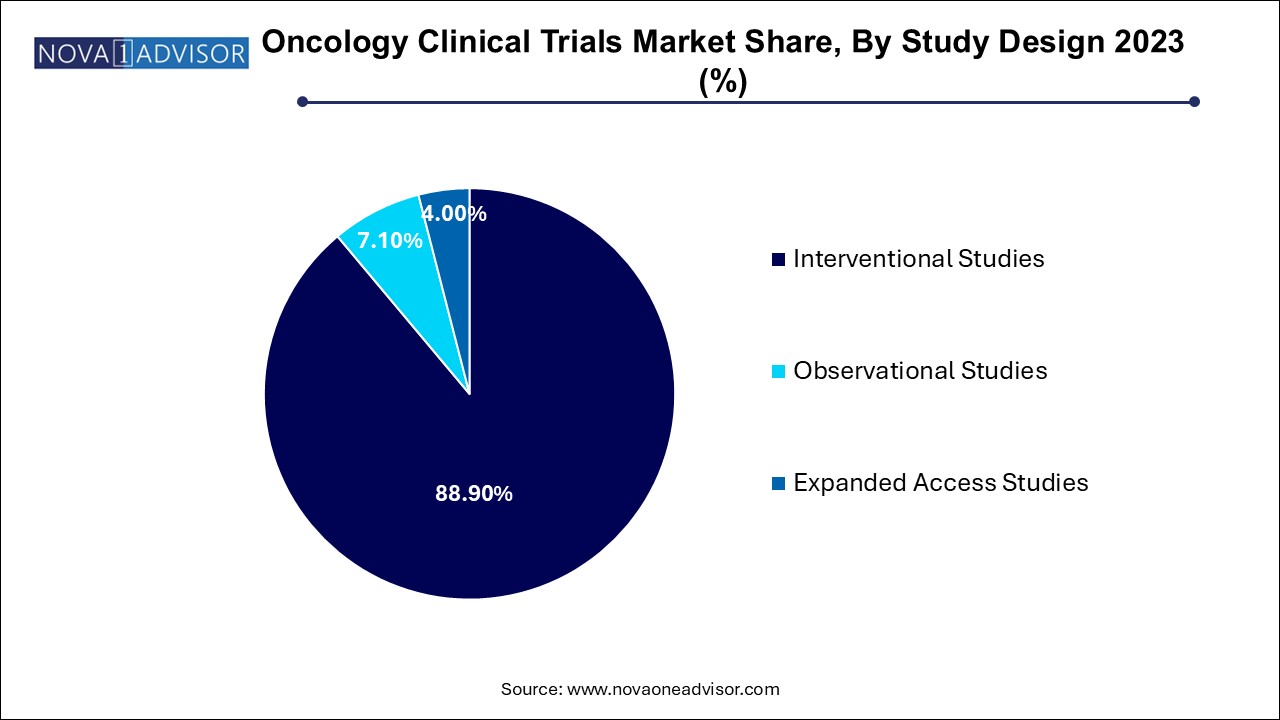

Interventional studies accounted for the largest share by design. These trials involve direct manipulation of variables, such as administering experimental drugs or combining therapeutic modalities. They are the gold standard for evaluating treatment efficacy and form the basis for regulatory approval. Most oncology interventional trials are randomized controlled trials (RCTs), with increasing adoption of crossover and factorial designs. Their dominance is supported by strong funding from pharmaceutical companies and CROs, alongside support from government-led cancer research programs.

Expanded access studies are the fastest-growing category, reflecting the ethical and compassionate drive to offer promising treatments to terminally ill patients outside formal clinical trial settings. As the FDA’s Expanded Access Program gains momentum, oncology drugs showing preliminary efficacy can be made available to patients who do not meet trial criteria. This model is especially important in aggressive cancers like glioblastoma or metastatic pancreatic cancer. Moreover, data generated from expanded access programs are being used to support real-world evidence submissions to regulatory authorities.

The United States, in particular, leads the global oncology clinical trials landscape due to a combination of factors: advanced research infrastructure, high healthcare expenditure, strong pharmaceutical presence, and progressive regulatory frameworks. The U.S. National Cancer Institute (NCI) sponsors numerous multi-center trials through its Clinical Trials Network, while the FDA's expedited programs like Breakthrough Therapy Designation and Accelerated Approval encourage rapid development of oncology drugs.

Furthermore, the presence of top CROs (e.g., IQVIA, Parexel), leading academic institutions (e.g., MD Anderson, Dana-Farber), and innovative biotech companies ensures a robust pipeline of studies. Canada also plays a key role, with extensive patient registries and strong participation in North American oncology research consortia.

Asia-Pacific is the fastest-growing region.

Asia-Pacific is experiencing a surge in oncology clinical trial activity, driven by rising cancer incidence, improved healthcare infrastructure, and a growing number of global pharma-sponsored studies. Countries like China, South Korea, India, and Japan are becoming hotspots for Phase I–III oncology trials. Regulatory reforms in China have shortened approval timelines, while large, treatment-naïve patient populations attract sponsors seeking faster recruitment and diverse data.

Regional CROs and site management organizations (SMOs) are expanding to meet demand, and governments are investing in clinical trial infrastructure. For instance, India’s National Cancer Grid is facilitating multi-site trial coordination, while Korea’s MFDS supports innovative trial designs. These dynamics are positioning Asia-Pacific as an essential contributor to global oncology research.

March 2025: Pfizer and BioNTech initiated a Phase II trial for a personalized mRNA-based cancer vaccine targeting solid tumors, leveraging learnings from COVID-19 vaccine development.

February 2025: IQVIA announced the launch of an AI-powered patient recruitment tool specifically designed to match oncology patients with clinical trials using EMR data.

January 2025: Merck & Co. received FDA clearance for its Phase III study of a novel PD-1/LAG-3 bispecific antibody for non-small cell lung cancer.

December 2024: Novartis expanded its oncology trial footprint in Asia-Pacific by opening four new trial centers in Singapore, India, and Australia.

November 2024: Roche launched a global umbrella trial to evaluate combination immunotherapies in advanced melanoma, using adaptive trial methodology and centralized biomarker analysis.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Oncology Clinical Trials market.

By Phase Type

By Study Design

By Region